Many equity investors now know that quality and competitive advantage (moats1) matters. However, identifying firms that can sustain these for the long term is not always straightforward. One way is to strictly focus on monopolistic companies, with strong and expanding moats. In this blog, we explore what investing in monopolies and oligopolies means, what the associated fundamentals are and how to most effectively invest in this theme.

Key Takeaways

- Monopolies and oligopolies provide mission critical products and services, bringing value to consumers.

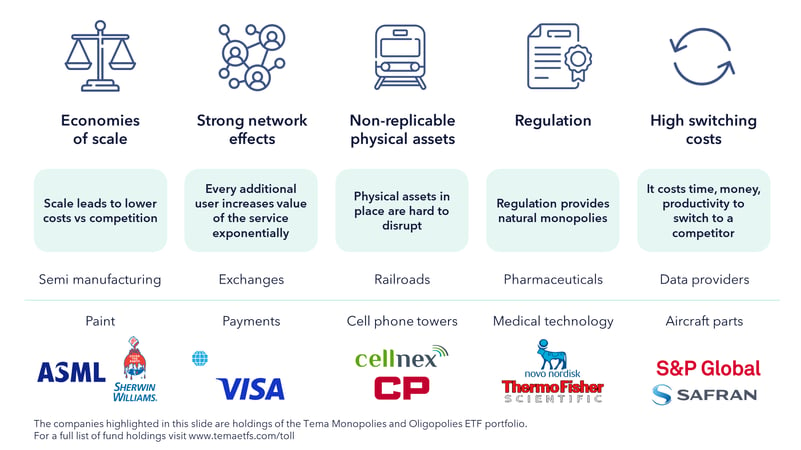

- They exist because of five key barriers to entry – economies of scale, network effects, non-replicable physical assets, regulation, and high switching costs.

- These companies exhibit pricing power, have long duration contracts, and recurring revenues.

- As a result, monopolies have the potential to earn high returns on invested capital (ROIC2) sustained for long periods of time.

- These firms tend to perform well during economic downturns. They also perform well in inflationary periods, especially those that are undervalued.

- TOLL seeks to offer exposure to what we believe are true monopolies and oligopolies

For a list of current fund holdings, please visit the fund web page at www.temaetfs.com/toll. All investments involve risks, including possible loss of principal. For a more complete discussion of the potential investment risks to the topics discussed below see the disclosure section at the end of the document.

What is a monopoly or oligopoly?

Mission critical businesses

A monopoly or oligopoly is an industry or market that is dominated by a single (mono3) or few (oli4) companies5. They may arise because these firms provide so much value to their customers, their products and services are mission critical.

Why do monopolies exist?

Monopolies and oligopolies tend to arise because of five key barriers to entry for new competition:

- Economies of Scale – As companies get bigger, they can produce things more efficiently. Just a single semiconductor facility, TSMC’s (Taiwan Semiconductor Manufacturing Company) Fab 18 in Taiwan produces a quintillion transistors every six months6. That is more than has ever been produced in all other factories everywhere in the history of the world. As a result of this scale, the cost of each transistor has plummeted exponentially, conferring a huge advantage to producers and consumers alike.

- Network effects – In a network, every additional user increases the value of the whole network for all other users. For example, and often taken for granted today, every additional merchant or customer added to the Visa network gives the whole network more value. Today Visa is accepted in 170 of the world’s 195 countries7.

- Non-replicable physical assets – Railroads, like the one operated by Canadian Pacific - the only single line railroad connecting all four corners of North America, are physical infrastructure assets that are natural monopolies, simply by the fact that it would make no economic sense to replicate them again.

- Regulation – Governments often create monopolies to spur innovation. For example, by granting patents to pharmaceutical companies like Merck, they allow substantial drug development risks to be economically rewarded.

- High Switching costs – Some services or goods are extremely costly to switch from. For example, Airbus and Boeing certify just two engines on each aircraft, usually those produced by the GE (General Electric)-Safran joint venture. Switching engines is prohibitively expensive.

These five barriers help create not only a “moat” around a company, but can lead to “expanding moats”.

Are monopolies bad?

It is commonly assumed that all monopolies are like Rockefeller’s Standard Oil and need to be broken up. But in fact, many monopolies often arise because of the value they bring to consumers. Think about how hard payments were before Visa, or how much some patented medicines have helped patients, or how Moore’s law8 has made semiconductors ubiquitous.

In the world there is only one company – Advanced Semiconductor Materials Lithography (ASML) - that makes the machines used by the biggest semiconductor manufacturers to make the most advanced chips. ASML uses 5,000 part suppliers9 to assemble these complex machines towering three stories. Without ASML, Europe’s most valuable technology company, we likely wouldn’t have AI (Artificial Intelligence), iPhones or any of the advanced technologies we use today.

Why should I consider investing in monopolies?

Monopolies often exhibit pricing power, have long-term contracts, and generate recurring revenue.

Monopolistic companies can have highly visible growing revenues, because:

- Pricing power is often contractually written directly into agreements. For example, toll roads charge fares that are inflation-linked.

- Long contract lengths which in the case of some infrastructure assets, like airports, can mean concessions stretching out 70-90 years.

- Recurring revenue. For example, 60% of Moody’s revenues are from subscription-based credit ratings or data/analytics10, helping provide stability to their top line.

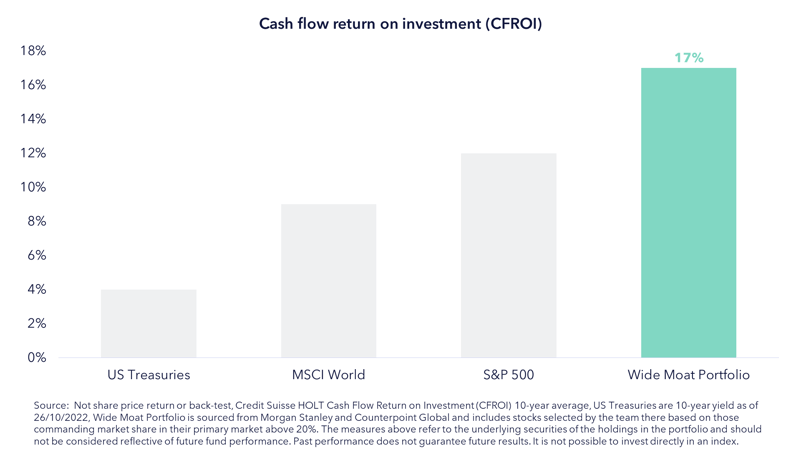

Monopolies have the potential to earn attractive sustainable returns on capital.

Together with sound cost management, those revenue advantages cascade down into a critical metric in investing – return on invested capital (ROIC). This metric calculates how much profit or cash flow a firm generates from the total amount of capital that has been invested internally.

Wide moat firms (seen as in the chart below), of which monopolies are a subset, generate returns that outstrip those of broader markets (like MSCI World11 or S&P 50012). Monopolistic firms specifically have the potential to compound these high returns for much longer

Exploring investment opportunities in monopolistic industries?

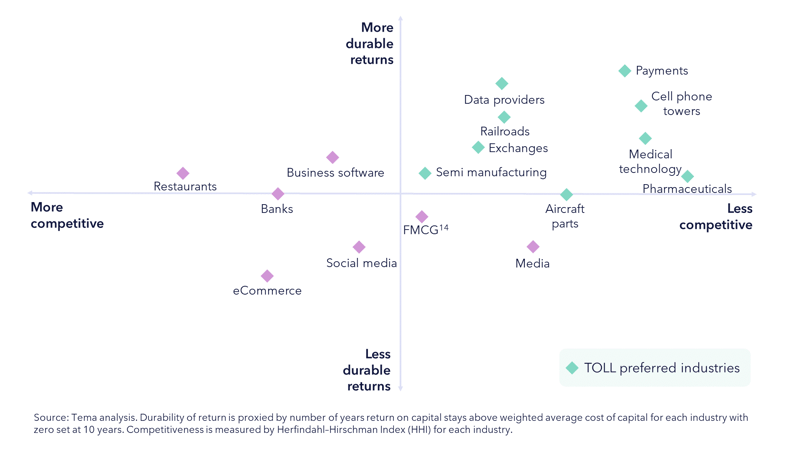

Investing in monopolies can be done directly by picking companies. However, identifying true monopolies can be difficult. For example, technology businesses might look like they have high returns and wide moats, but history suggests they are often not sustainable and prone to waves of disruption. Venture capitalists have invested $1.4 Tn in tech ventures globally since 2015, and over 600,000 new tech firms have been created13. This has given birth to TikTok, AI, ChatGPT and other disruptive forces. In this context, is Google a monopoly?

What is the TOLL ETF?

Tema Durable Quality ETF (TOLL) is an actively managed fund that seeks to invest in mission critical businesses operating in monopolistic industry structures. The fund will aim to invest in what we consider to be true monopolies, meaning industries that are vital, have expanding barriers to entry, and durable advantages.

Thematic investing in monopolies: why active management makes sense.

Having an investment professional build a thematic universe can lead to advantages.

- Stocks are selected not mechanically, but by identifying true monopolies or oligopolies. This matters because not all competitive advantage is created equal. For example, while it is generally accepted that media firms have competitive advantages (e.g. Disney), their returns lack durability. Why? Entertainment media is not mission critical and is limited in that it fiercely competes for the 24 hours of human attention span.

- Dedicated focus on a thematic space means faster reaction to changes in its composition. Tema carefully monitors the disruption landscape of the firms we invest in, whether it comes from governments or the inevitable challengers, to assess the moat’s integrity.

Why should I consider investing in TOLL ETF in the current environment?

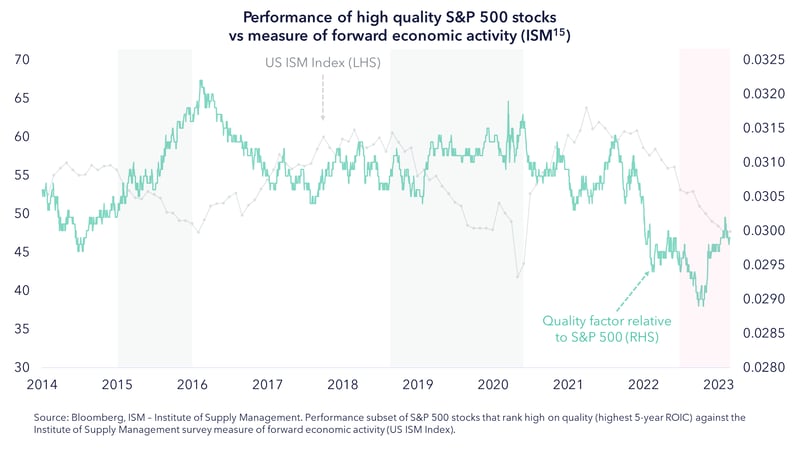

Monopolies have the potential to outperform in economic downturns

The Institute of Supply Management (ISM) index15 is an excellent leading indicator of economic activity. It is a diffusion index, meaning any reading below 50 indicates a contraction. When the ISM starts to fall, economic activity usually starts to decelerate. Historically, when this happened (shaded areas in the chart), quality companies (the broader category in which TOLL seeks to invest), started to outperform.

2022/23 has been very different. Although the ISM has been falling for months, this time the quality segment hasn’t outperformed, creating an intriguing opportunity.

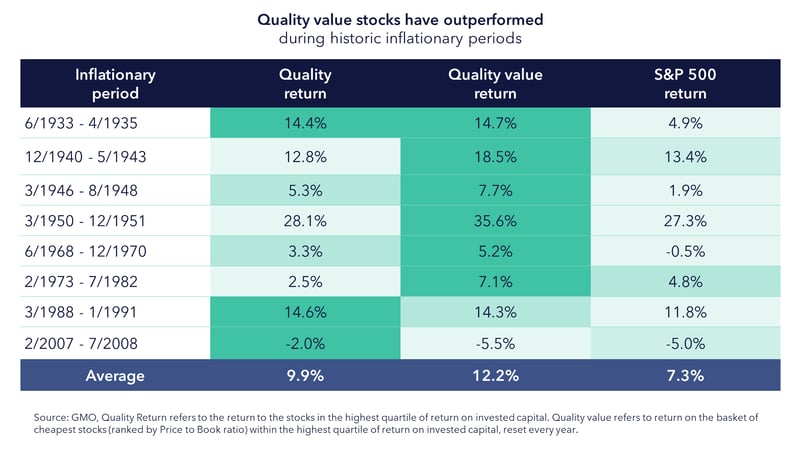

Monopolies and Oligopolies also have the potential to do well in inflationary periods

Inflation has been a feature of the economic landscape since 2022. Looking at previous historic periods of inflation in the below table, from 1933 to the infamous 1970s, quality stocks tend to outperform. However, the second column indicates that the quality stocks that do best in historic inflationary periods are those that are cheap. So it isn’t enough to buy quality, one needs to also pick attractively valued stocks. This is exactly what TOLL’s actively managed investment process aims to do.

What are the risks behind investing in monopolistic industries?

There are several risks worth considering:

- Anti-trust - Market power is always associated with a risk of government intervention on the grounds of abuse of dominance or other anti-competitive behavior. Our active management process can mitigate this risk by carefully monitoring news flow coming from the Department of Justice (DOJ), The Fair-Trade Commission (FTC) and the European Commission.

- Disruption - Entrenched businesses have their moats constantly under siege by would-be competitors. This risk is usually more acute in some industries (technology) than others (toll roads).

Bottom line

Investing in quality stocks or those with moats is a well understood long-term approach. However, not all companies with these characteristics are created equal. Investing in monopolies and oligopolies aims to select the strongest of this group – companies with expanding barriers to entry, capable of generating sustainable returns on internal capital over very long periods.

Back

Back

.png)